Locate the Right Home Loan Broker: Simplifying Home Financing

Browsing the intricacies of home financing demands a strategic technique, particularly when it comes to picking the appropriate home mortgage broker. An efficient broker can improve the process, aligning your distinct economic profile with optimum home mortgage options tailored to your needs. Not all brokers offer the exact same degree of knowledge or service. Recognizing the important qualifications and high qualities to look for in a broker can significantly influence your home-buying experience. As we discover this important subject, consider what elements genuinely matter in making an educated choice.

Recognizing Home Mortgage Brokers

In the realm of home financing, recognizing home loan brokers is vital for prospective homeowners. Home mortgage brokers serve as intermediaries between borrowers and lending institutions, assisting in the funding acquisition procedure - veteran home loan. They evaluate customers' monetary scenarios, choices, and needs to determine suitable home loan items tailored to private situations

Furthermore, brokers commonly handle the application procedure, alleviating much of the tension associated with protecting a home loan. Ultimately, recognizing the role and advantages of home mortgage brokers can encourage potential home owners to make informed choices in their home funding journey.

Key Credentials to Look For

When selecting a home mortgage broker, particular credentials can considerably affect the total experience and end result of the home financing procedure. One of the primary certifications to think about is licensing; make sure the broker holds a valid permit to operate in your state, as this indicates they fulfill regulative standards.

Experience is an additional essential variable. A broker with a number of years in the sector is most likely to have actually developed connections with loan providers and a much better understanding of market patterns. Try to find brokers who focus on your wanted kind of financing, whether it be new property buyer programs or investment residential or commercial properties.

In addition, a solid record of successful purchases speaks volumes. veteran home loan. Examine for client reviews and evaluations that highlight the broker's ability to shut car loans efficiently and give outstanding client service

Certifications, such as those from the National Association of Home Loan Brokers (NAMB) or the Mortgage Bankers Association (MBA), can likewise show professionalism and reliability and commitment to recurring education and learning. Finally, interpersonal skills must not be overlooked; a broker that connects clearly and pays attention attentively will be much more effective in understanding your one-of-a-kind monetary helpful site needs.

Questions to Ask Prospective Brokers

Choosing the appropriate home loan broker includes not only examining their certifications yet additionally engaging them with targeted inquiries that expose their expertise and approach. Begin by asking about their experience in the industry. Ask the length of time they have actually been agenting car loans and whether they specialize in particular kinds of mortgages or customers, such as new buyers or financial investment properties.

Next, analyze their interaction design. Ask how frequently they will certainly upgrade you throughout the process and their preferred approach of interaction. This will help you determine if their interaction lines up with your expectations.

You must also ask about their lending institution relationships. Comprehending which loan providers they deal with can offer understanding into the selection of car loan alternatives offered to you. Additionally, ask just how they deal with potential difficulties throughout the mortgage procedure and their method to analytic.

Assessing Broker Costs and Costs

Comprehending the numerous fees and expenses linked with hiring a home loan broker is crucial for making a notified decision. veteran home loan. Home mortgage brokers might bill a range of costs, including source charges, which compensate them for their solutions in securing a lending. These fees can range from 0.5% to 2% of the lending quantity, so it's important to clarify this upfront

Last but not least, understand any kind of secondary prices that might emerge, such as application costs or credit rating report charges. Request a detailed breakdown of all costs involved before authorizing any kind of arrangements.

Contrasting charges across different brokers can help recognize that uses one of the most competitive rates and services. Inevitably, a detailed analysis of broker costs and prices is necessary for making certain that you pick a home mortgage broker that provides value without unforeseen monetary shocks.

Structure a Solid Broker Relationship

A solid partnership with your home mortgage broker can dramatically enhance your home-buying experience. Developing depend on and open communication is paramount. Begin by being clear regarding your financial scenario, including your earnings, debts, and credit report. This sincerity enables your broker to supply tailored remedies that line up with your needs.

Regular interaction is crucial in cultivating a strong connection. Schedule constant check-ins to discuss development, pop over to this web-site address concerns, and clear up any kind of concerns. This aggressive method maintains you informed and shows your commitment to the process, permitting your broker to better comprehend your preferences and concerns.

In addition, think about giving comments throughout discover here the trip. Constructive objection or appreciation assists your broker improve their approach, making certain that your expectations are fulfilled. Building connection can additionally lead to much better negotiation outcomes, as a broker that values your partnership is most likely to support vigorously on your behalf.

Conclusion

Finally, choosing a proper home mortgage broker is essential for a streamlined home financing process. A well-informed broker not only helps with accessibility to different loan providers yet additionally gives beneficial understandings right into the home mortgage landscape. By taking into consideration key qualifications, asking important concerns, and assessing connected fees, individuals can make informed decisions. Establishing a strong partnership with the picked broker better boosts interaction and trust fund, inevitably adding to a much more effective and less difficult home-buying experience.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Richard Thomas Then & Now!

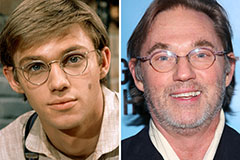

Richard Thomas Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!